Browse the list to create Michigan LLC Operating Agreement for your company. On this page, you will find all the information about LLC operating agreement, their types, and how to form an LLC in Michigan. Also, we will share some interesting things about operating agreements that will help you in the process.

What Is Michigan LLC Operating Agreement?

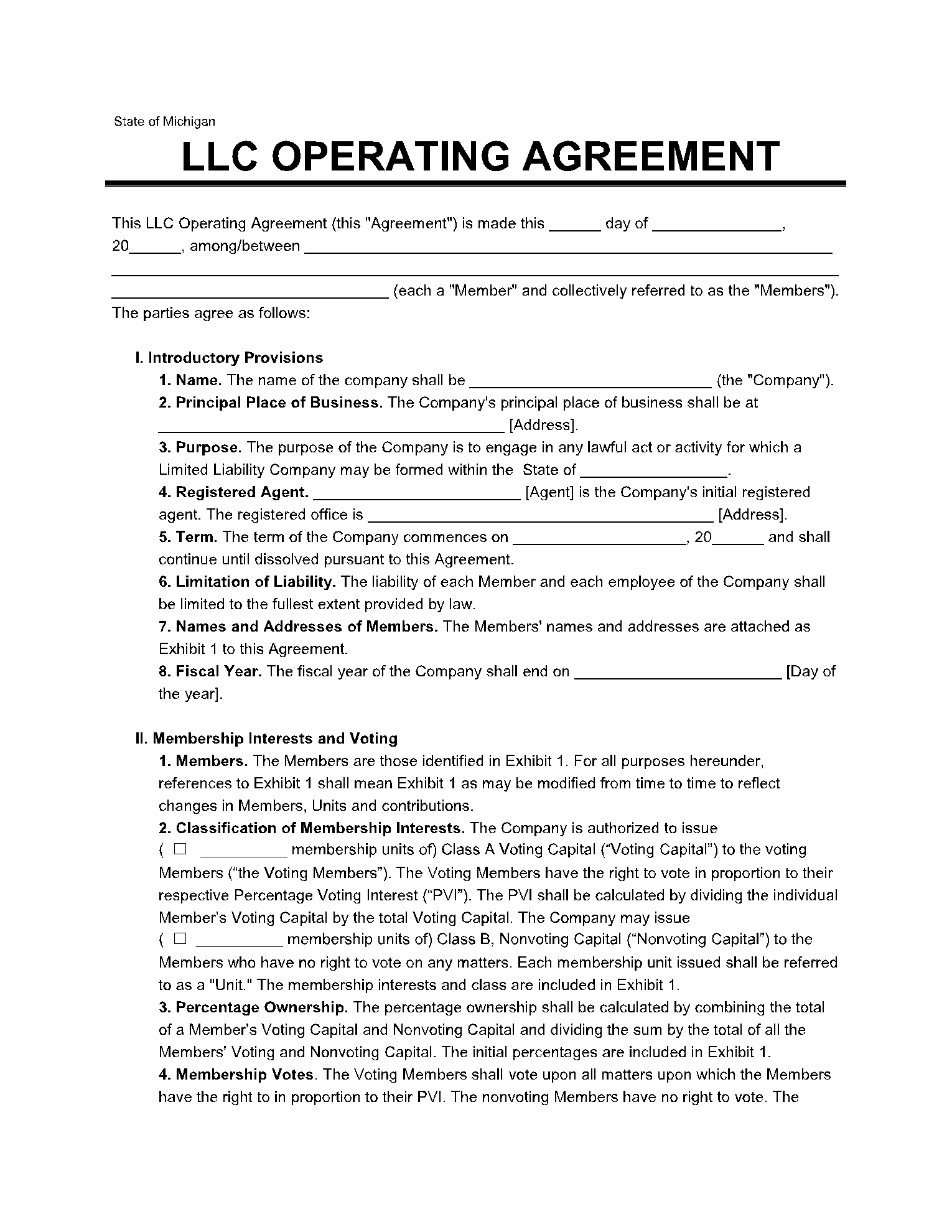

Michigan LLC Operating Agreement is a legal document drafted by an LLC that outlines all the functions and motives of a business. It is designed and managed by the members of the business entity, mentioning the roles of each member in the incorporated company. It is optional to file this document as there are no official requirements by the state of Michigan/

However, many other benefits motivate businesses to create an operating agreement. The biggest advantage of this document is its ability to prove the limited liability of each member. Thus, it helps in living the basic idea of a limited liability company.

What Types of Michigan LLC Operating Agreement Should You Choose?

There are two types of operating agreements for LLC- Single-member and Multiple members operating agreements. The first one is used when a company is registered by a single member and there are no other parties involved in the management of the company.

On the other hand, multiple member operating agreement is created when the company has multiple members with different shares in its capital.

For single-member LLC, the operating agreement is used to separate the legal entity from the assets of the sole owner. However, a multi-member LLC uses it to prove its limited liability and to set some regulations for the company.

How to Form a LLC Operating Agreement in Michigan?

Forming an LLC in Michigan requires you to follow these easy steps:

Step1- Get an Agent

The main thing is to find a registered agent who can help you incorporate your company. The person can be an individual or a firm acting on your behalf.

Step2- Choose the Type of LLC

You can register for different types of LLCs based on ownership and state-bounding policies. Based on members, you can either go for single-member LLC or multiple-member LLC. Both the companies can be registered from the same process. However, you must mention it on the initial documents to start the process.

On the other hand, you can decide whether you want to register the company within Michigan or outside Michigan. After choosing the type of LLC, move to the next step.

Step3- Pay Filing Fee and Submit the Application

You need to pay a $50 filing fee to incorporate your company. Additionally, you need to gather all the required documents and submit them along with your application. The application can either be submitted in person or through mail to the Michigan Department of Licensing and Regulatory Affairs Corporation.

Step4- Get Employer Identification Number

An EIN is required by the limited liability company, in case they want to pay their employees through the salary plans in a bank account. That is why it is important to fill out the online application for EIN after registering the LLC.

Tip: LLCs can create an operating agreement to get a written document of their statements.

Why LLCs Should Create an Operating Agreement in Michigan?

The fact that Michigan State does not require LLCs to create operating agreements can confuse some people. Although it is not a legal requirement, you still need an operating agreement to list the share of each member in the LLC. Also, it has all the business details including how the company will carry out its business activities with the proper framework.

The biggest advantage of creating an operating agreement is that it gives each member status of limited liability to the company.

Conclusion

Filing an operating agreement for LLC in Michigan is easier than you think it is. All you need is a registered agent to submit your application. Additionally, they can help you with all other legal requirements to register an LLC in this state.